Investors need a "you usually are here" content label to be able to assess exactly where these are along with what sits in advance because they endeavor to find their way their lessons easily when it comes to tolerable prices associated with go back within the financial markets.

In this web site posting I provide as much as that minute data from many procedures which I hope will certainly firmly affix the "you tend to be here" brand though attaining a glimpse in the route in which sits ahead.

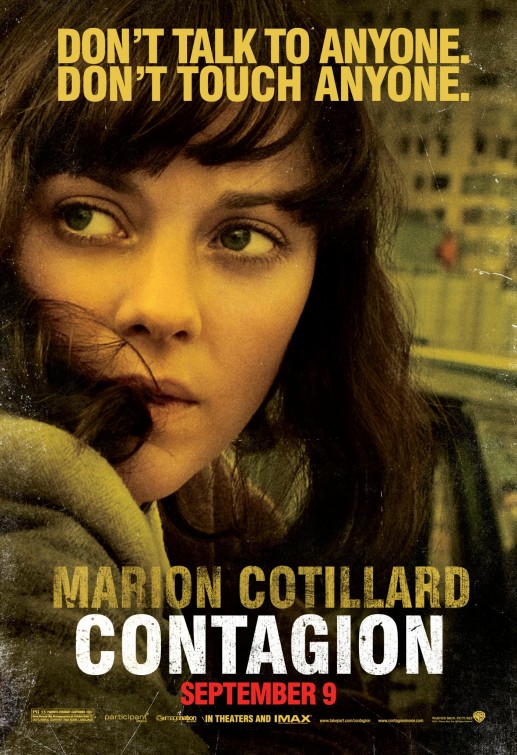

Let's take a look during global psychology first; because attack connected with knowledge in the unsecured debt problems in Greece along with anxiety associated with wide-spread contagion, government authorities include shed that political will to be able to handle fiscal troubles correctly even though keeping away from your world wide growth deceleration effective at reversing the particular stunning obama's stimulus bundles on the recent past.

Austerity can be quite in style through the globe, in addition to their causes at this time get pleasure from the particular moral large surface as a lot of important government authorities across the world are usually within intensive strain to get rid of govt expending support from other economies. This could possibly bring about one of several major contractions throughout federal government support inside decades. World governments can be dedicated to boosting fees on revenue in addition to intake in addition to inadequately specific expiring government programs anticipated to be able to sap 1.3% from American GDP around 2011, a physique that will increase somewhat whenever Congress were to keep your expansion regarding George Bush's taxes cuts. Globally the following topic will certainly end in a estimated 1% reduction in GDP,the most significant synchronized budget contraction in at the very least three decades.

Investors are usually now recognizing that their earlier fears of inflation were unjustified, quite the actual very much darker enemy deflation is actually distribution through the economy as a cancer sickening the actual already weakened equilibrium sheets regarding consumers whom ended up only starting point to believe the growth report globe authorities are actually promising. Central planners missed by way of state mile the one obama's stimulus bundle in which might have at the same time hammered out devastated client steadiness bedding and those people involving finance institutions some sort of rebate that will every American family members on the national taxes it possessed paid for over the previous three years, which has a need paying decrease residence unsecured debt by using 50% belonging to the rebate.

The entire fees of the form of government might have recently been less than what exactly have been expended to be able to night out that will best the deposit system pump though absolutely disregarding your stalled consumer pump. Think for the time how a great government package would have impacted your economic situation. Each and every taxpaying citizen would have been given stimulus either permitting all of them to whether the actual storm, in order to opportunistically spend money on the particular really asset lessons that have devastated countless households.

The work office merely produced data suggesting which the latest career market place offers undergone failures which might be double just as much as just what takes place for the lows involving regular recessions/job loss cycles. More important this specific facts provides even more data that this existing economic recuperation provides started to cool, this will include an impact on long run client paying at precisly your period governments accept investing cuts.

Globally that picture is mostly your same, authorities embracing austerity as well as considering boosting taxes to help shore in place their own balance sheets, banking companies tend to be largely insolvent having bit of motivator for you to threat capital by simply providing credit the item to consumers exactly who may not be equipped to cover it back provided the actual effects with job deficits and depreciated family members sense of balance sheets.

Investors commence to focus on stock game specialised signs or symptoms if your important signals fail to generate any enthusiasm for investing. Yes, real estate markets will be likely oversold; nonetheless a lot of the perfect diminishes inside record came from oversold levels. In point all of us just simply got another keep industry confirmation on Friday coming from Dow Theory where by by way of each Transports and industrials click brand-new reduce shutting lows, in addition to the particular fifty day time moving average features simply entered over the 2 hundred time average inside S&P what exactly a number of large contact this Death Cross, a really bearish warning that should probably possess the S&P beneath 875 as well as the industrials below 8500. Alpha Fiduciary presently comes after about three of the a lot of very well well known employees whose prospects range from adverse to catastrophic.

While the sole point more intense when compared with crafting most of these ideas is actually reading through them, receive comfort and ease around fully understand everyone possibly not just learn "you are usually here" nonetheless of which Alpha Fiduciary while a person's guidebook spends it is purchasers across five varied asset lessons in addition to has developed one of a kind range criteria to optimize the outcome produced by each one property class compared to its benchmark. We also enjoy the overall flexibility that will convey each one utility elegance in the direction your substantial study along with technical work provides identified prudent.There possesses by no means happen to be a more rewarding moment for our tactical, directional expenditure approach towards chance reduction, along with opportunistic allocation regarding your client's portfolios.

We tend to be particularly fired up to announce in which most people have not too long ago succeeded around owning our own expenditure of money types acquired upon a high step 401K pension prepare platform. If you would like to explore how this particular growth can assist you manage your pension plan possessions from the above mentioned environment, please contact Mike Shea during Michael@alphafiduciary.com.

Be Well.

For ideas regarding Alpha Fiduciary in addition to how many of us manage wealth goto: www.alphafiduciary.com