THE NORTH ATLANTIC DEBT CRISIS: LESSONS FOR EMERGING AND DEVELOPING ECONOMIES

Written By: Shafii Ndanusa, Abuja.Nigeria.

The failure regarding no cost sector economics in the West resulted in that Great Depression with 2008 and now the particular North Atlantic Debt Crisis of 2011. Like a cancerous disease, the particular unsecured debt problems in the euro area provides created some type of economical osmosis along the European Union. The edge of every location across theUnionhave grow to be more just like semi-permeable membranes that permit that transmission on the indicators and also in truth the sickness connected with economical mismanagement. FromGreece,Ireland,Italy,PortugaltoSpainthe sovereign debt uncertainty from the euro zone possesses extended to yield concern amongst stakeholders.

The United States with Americanarrowly risked a sovereign unsecured debt default within the second associated with August 2011, with Congress last but not least agreeing to your deal to help raise bill limits. The credit standing agency; Standard along with Poor's cut down theUnited States standing from your triple A status. Within theUnited States, there has been widespread self deprecation associated with Standard & Poor's downgrading of theU.S. financial system having little awareness paid for towards the truth behind that downgrade. The fragility belonging to the American financial system shown the idea on the negative styles within the European economic climate and vice versa. At your moment, the actual multiplier result with the following cyclical sovereign unsecured debt uncertainty around theNorth Atlantic countries is definitely still to be thoroughly ascertained.

The sovereign personal debt crisis can be evidently a menace on the carried on supremacy involving your United States Dollar plus European Euro within the intercontinental forex market. To prevent a systemic disaster, the U.S. Congress predetermined to some package to be able to bring up the country's credit card debt ceiling paving the actual technique intended for President Barack Obama's Administration to boost its price range deficit. The European Union equally decided help it has the debt-ridden representative places in the proceed to avoid a local systemic failure of the European economical system.

Paradoxically, theUnited States of Americaand your European places have regarding long been viewed as beacons associated with capitalism and also the particular region having number one concentration of superior economies. The financial systems of the nations around the world mostly thrived about the ideological key facts associated with free industry economics, until finally the actual bubble busted a few years back. The Global Great Depression of 2008 as well as the existing North Atlantic Sovereign Debt Crisis symbolizes further outcomes of this particular failure.

It is definitely instructional pertaining to political as well as economic frontrunners involving coming through and building countries that will note of which the particular principles along with training associated with free sector economics while in the final thirty years provides contributed to increased disequilibrium plus asymmetry all around plus among parents and nations around the world using a international scale. Rather in comparison with guarantee equitable redistribution involving wealth amongst people in addition to nations, free of charge current market economics ended in further widening regarding this difference somewhere between the actual prosperous as well as poor.

The unrestricted totally free market place economics ideology that's largely driven by class interests further focused that already powerful along with weakened your witout a doubt weak. The net sale effect seemed to be needless to say enormous disequilibrium throughout nations, substantial global unbalances in industry and also national fiscal destitution. Even the particular superior economies had been practically captured napping once the karma-like consequence of global financial mismanagement struck within 2008.

It is definitely imperative to take note that for nations for you to overcome their found along with future economic challenges, your trajectory of financial talked about their leaders need to be clear. Such financial expectations have got to end up being determined by realistic, handy and fair precepts. Rather compared to easily counting on hyped ideology plus training interests, economic policies needs to be all-inclusive, aimed and search for in promoting equality in addition to widespread access to the basic tools expected pertaining to financial development.

The 2008 Global Economic Recession resulted in a new regime associated with monetary stimulus in many nations. This was in inclusion in order to budget slashes by means of several Governments. In quite a few instances, your budget cuts disturbed negatively about the provision connected with vital financial infrastructure as effectively as resulting to an raise in unemployment levels. Apathy, civil regret and lower output sets within all this in the end leads to a regime associated with slower GDP growing seeing that is at this time seasoned for most state-of-the-art economies. Suffice that for you to be aware this slower GDP growing applies to a nations' ability that will assistance its sovereign bill duty as at whenever due.

This situation organized the history for just a to some extent realistic argument with regard to enhanced Government monetary allocation and also spending. Having stretched to the limits it is internally-generated solutions connected with funds, the Governments tactic the debt marketplaces cap with hand to help create funding for expansionary fiscal budgets. Unless monetary spending is actually obviously prioritized, rationalized and also restricted the tendency intended for impulsive financial making decisions is definitely similarly serious with almost all Governments, because though they were individuals. This way, that hills associated with sovereign credit debt continue on for you to logpile in place with improving settlement obligations year in year out.

This bike of reliance on personal debt money remains gradually in that way hampering a Government's overall flexibility along with versatility to obtain involving its present and also potential profits in any style that it deems fit. The nation then faces the difficulty of your fragile financial system. This issue can be higher any time a border country maybe a major buying and selling partner will be bedeviled having a sovereign credit debt crisis. The personal osmosis arises while it becomes obvious in order to both celebrations that swimming and sinking needs to be done together.

In June 2011, the International Monetary Fund (IMF) reduce your U.S.2011 GDP Growth Forecast to help 2.5% on the 2.8% prior forecasted. The IMF in addition warned on the sneaking sovereign debt problems have to this United Statesand another European states neglect to minimize their spending plan deficits. The U.S.on the 2nd regarding August 2011 decided an issue in order to boost your country's personal debt ceiling. What are the crucial training untouched within this to get emerging and getting locations associated with Asia, the Middle East, Sub-Saharan Africa along with theSouth America?

Following Standard and Poor's downgrading from the US debt, stock options exchanges while in the North Atlanticand rest from the world experienced considerable drops throughout whole market capitalization.A highly volatile interval involving trading and investing was observed with a very few days. In resolution short selling of commodity was banned on particular shares in many nations around the world so as to avert the extended totally free drop involving stock prices.The resulting Gold Rush encountered about the New York Mercantile Exchange as good like nations around the world likeThailand wasbeacuse with investors anxiously seeking harmless havens away from the conventional investment exchanges. Gold offered intended for more than 1,800 U.S. Dollars for every ounce as well as provide actually dropped short connected with demand. Although, this keep deals along the North Atlantic will be likely to come back soon, some analysts will be on the perspective this shall be yo ur short-term recovery. It is thought that right after the particular rebound, the value regarding futures with these deals are going to be a expression of these economic simple fact rather then due to the actual presentspeculative activity.

One of the major results connected with this North Atlantic Debt Crisis is a very clear threat is actually poses on the U.S. Dollar and also the European Euro when means of foreign exchange. Just similar to individuals, nations around the world from the globe might normally commence to search for pertaining to safer havens with various other rather secure worldwide stock markets (such as the Chinese Yuan) in addition to commodities (such while Gold). The basic safety with fiscal assets as well as assets usually are major considerations that can establish these kind of choices.

Some analystsare from the viewthat political and fiscal leaders need to focus moreon restructuring their particular economic climates through addressing the crucial aspects thatimpact oneconomic performance. Instead, there looks as a rising temptation in order to follow the actual familiar outdated path of ideology as well as course interests, shrouded as just stated while in the would mould associated with no cost marketplace economics. The continuous deposition connected with sovereign unsecured debt isn't widely known as some sort of long term solution. The older proverb is always genuine in which when not having resources, depend on resourcefulness.

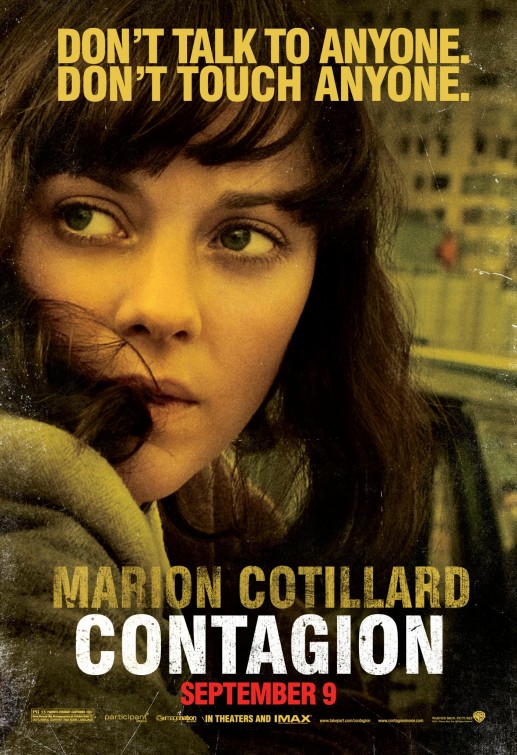

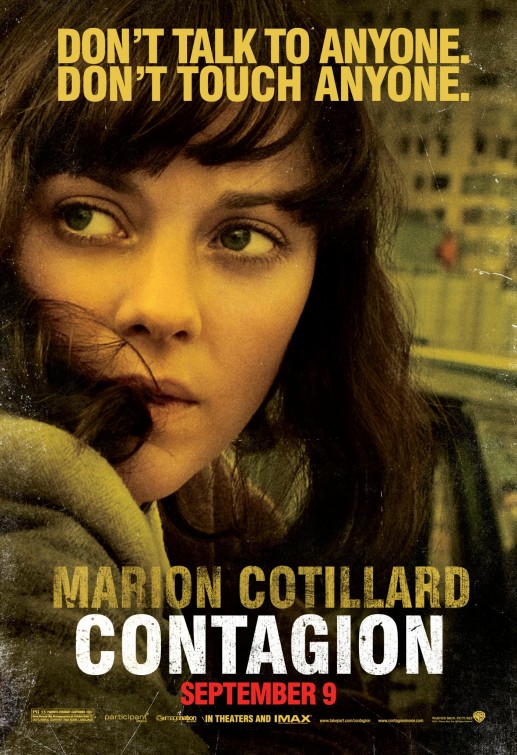

In a commentary published about www.project-syndicate.org titled; A Contagion of Bad Ideas and created by way of Joseph E. Stiglitz, Nobel laureate plus Professor with Economics during Columbia University. He acknowledges the particular issue related to fiscal contagion between Europe in addition to America along with vice versa. However, he / she further mentioned that will "But your authentic problem stems from another way of contagion: negative strategies move very easily throughout borders, plus misguided financial notions about both equally sides of the Atlantic are already reinforcing each and every other. The exact same will probably be true in the stagnation that these types of coverage bring".

In conclusion, political plus monetary management around emerging and also developing financial systems should heed that vital point that a group of customized, brand-new in addition to sweeping technique in order to economic thinking is necessary in the event that being successful is actually sought after in monetary management. No location is definitely an snowdonia and every country possesses its own distinctive peculiarities which will must be tackled inside training course regarding economical modeling. To this end, unconventional economic intelligence will be game. As negative or maybe slower world wide increase shows up for the horizon, it is instructional this national global financial management believe profoundly and dig profoundly if you wish to limit the particular exposures health of their home financial systems for you to this unfolding crises. Perchance it may be beneficial to stay these tips in mind inside training course connected with developing a avenue for fiscal survival, economical expansion in addition to development:

Do Not Rely Completely on Free Market Economics. AvoidPilingMountainsof Sovereign Debt. Seek Out Alternative International Reserve Currencies as well as Commodities. Commit to Frugal Economic Policies of which Promote Equality. Commit to Human and Physical Infrastructural Building. Seek a Healthy Balance involving GDP GrowthTargets in addition to CPI Inflation Targets. Consider Protectionism where by necessary. Prioritize and Rationalize just about all Economic Expenditure. Seek Maximum Growth from Internally Controlled/Generated Capacity Be Innovative around Economic Thought simply by Seeking New Ways regarding Solving Economic Problems.