If the Fed Pre-book Traditional bank caused the takeover of Tolerate Stearns by JP Morgan, they offered a thing session in main lender burden which the Traditional bank of Britain must study and break down.

The Fed's input is astonishing because that Tolerate Stearns is not a lender. This can be a economical intermediary, that is certainly, a good investment corporation. There initially were no wrinkles of retail shoppers outdoors their Ny place of work, waiting around to distance themself their the world's benefits.

Nonetheless, the Raised on resolved that Tolerate Stearns cannot be allowed to fail.

The interest rate from which functions unfolded is impressive. Tolerate Stearns went to the Securities and Exchange Commission on 13 Goal, proclaiming that it had been preparing to declare bankruptcy. On the identical evening, JP Morgan announced that it was loaning some US$ 50 zillion to deal with for your thirty days, underpinned by way of the Raised on. By Thursday sixteenth, JP Morgan obtained manufactured a suggestion among us$ 2 a share which sought after Tolerate in a derisory US$ 236 trillion. On Friday 17th, JP Morgan workers have been put in at Tolerate and effectively had taken power over surgical procedures.

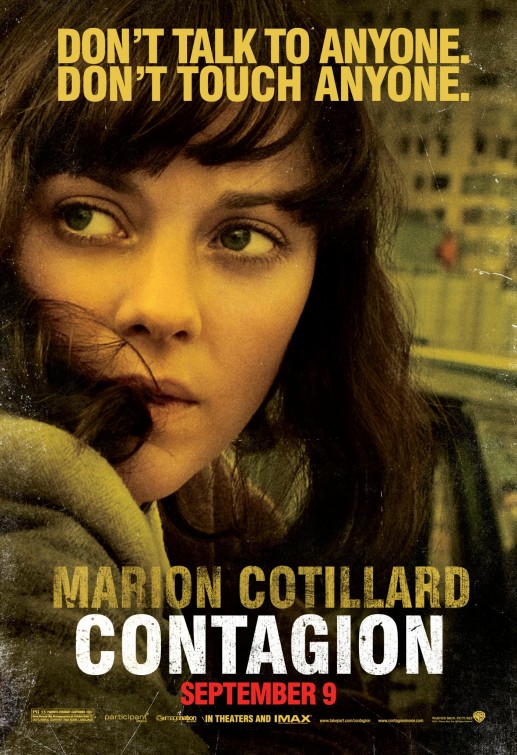

However Tolerate lacks retail depositors, the company is at the centre of quite a few major foreign offers and positions. Just unravelling these positions is a extended and convoluted process that would also lure other US corporations on the mire. The Raised on would not want the contagion to distributed to other banking institutions.

Investors are dismayed that Tolerate is sold for all of us$ 2 every share and that JP Morgan have attained major belongings in a shoot selling price. Bear's inventory strike US$171 this past year and shut down at US$ 50 right before the takeover. Nonetheless, you'll find not many experts with criticised the Fed's action.

The Raised on also had taken action to boost the status of Lehman Inlaws who had been the item of bad marketplace rumours. They seemingly telephoned a lot of US and foreign banking institutions proclaiming that Lehman was synthetic cleaning agent and relished the Fed's self-confidence. Regardless of a value slip of 20Percent on 17 Goal, Lehman gives flower by 45Percent on Thursday if it released a firm statement.

It shouldn't be assumed the fact that Raised on will help any US loan provider. Only the major gamers love this unique freedom.

Carlyle Investment is on New york stock exchange Euronext alternate at Amsterdam, while it is was able from Ny. It regulates US$ 81 zillion of purchases and has now true estates offers to value of US$ 229 zillion.

The pay for attained the suspect difference of leveraging its value more than 32 moments, and utilized this personal debt to advance acquiring housing mortgage loan guaranteed securities. Just read was from Freddie Mac and Fannie Mae.

It can be these exact securities, with treble A reviews, that contain percolated from the foreign checking technique. The diminishing these securities prompted the latest credit rating dilemma.

By 14 Goal 2008, Carlyle obtained in serious arrears on personal debt monthly payments. Many of its major debt collectors obtained recently gotten comfortable personal loans from the Raised on. Their rapid economical toughness gave them the self-confidence to experience hardball with Carlyle and confiscate the guarantee. Banks attained Carlyle's belongings cheaply. We can further benefit by swapping these tainted securities for beautiful US Treasury Ties using a replace structure announced by way of the Raised on. It is really an surprising and extensively unhealthy result of the Fed's steps to compliment the key gamers.

On the other side with the Atlantic ocean, the Northern Steel fable will continue to unfold.

Northern Steel has announced its long term plans for your interval nearly 2011. As you expected, the priorities with the British Treasury have influenced the tactic, which will depend on the conclusion of paying Sterling 30 zillion of general public financing.

As usual the expression 'nationalisation' sits dormant and is particularly swapped out by way of the euphemism of 'temporary general public ownership'.

First, As a way to pay off the Sterling 30 zillion, your banker will effort to reduce its asset platform by half and drastically reign in the quality of new mortgage loan innovations. What this means used is the fact half of Northern Rock's mortgage loan holders will have to receive their mortgage loan and take away a new mortgage loan with a further loan provider. The dimensions of this suggestion is shocking. Northern Steel has some Sterling 110 zillion in mortgage loan innovations together attained a 20Percent business for many new house loans in 2007.

This goal is only able to performed if other banking institutions or developing organizations are able to afford and ready to offer re also-house loans to Northern Steel shoppers. At the moment, all indicators point in the exact opposite track. Brokers are cancelling offers to individuals and requiring new individuals to improve their stores to 10Percent and up. A Northern Steel consumer, who relished home financing development of 125Percent, can get it each hard and unsightly emigrate into a 90Percent mortgage loan.

Second, Northern Steel aspires as a benefits lender. Because of this the previous scheme of aggressive extension, based upon short term money from the from suppliers marketplace, is going to be tried by long lasting stores from retail shoppers. In other words, credit utilizing banking institutions is going to be swapped out by stores from individual shoppers. These party are generally older individuals salvaging for his or her retirement life.

When Northern Steel is still nationalised, and will continue to offer appealing costs for savers, this purpose may be accomplished. Other banking institutions will bleat about above market competitors, along with the European union could be an discomfort. Nonetheless, if and when your banker is deemed completely ready for get back to the individual field, there will probably be a quick and devastating outflow of money that would have echoes with the operated with your banker in Aug 2007 which motivated the initial dilemma.

In recent times, Liverpool has evidently overtaken Ny as the primary international economical heart. However Tony a2z Blair and Gordon Brownish have advertised credit rating with this, the reality is the fact that nominal degree of unsafe effects of British trading markets urged foreign investment and economical gamers to locate there. The Metropolis of London manufactured these novices encouraged, and even shared advancement and change included in the lending options and dealing approaches. Liverpool has become the capital of planet financing, in addition to a preferred playground for the affluent and celebrities.

The lengthy sage of Northern Steel, which entered Aug 2007 and which will operate up until the lender is went back on the individual field, has dogged the foreign trustworthiness of Liverpool. The British Isles experts have shown their wherewithal to manage an emergency.

The fast and bold action with the Raised on when controlling Tolerate Stearns has astounded foreign markets and shown the determination of america to lessen the after effects from the market meltdown.

The credit emergency began the united states, along with the Raised on has behaved decisively. No major US lender or loan provider will fail. The contagion distributed on the British along with the British experts dithered for six a few months. At the end of the period, we were holding intellectually down and out and turned on the basic Outdated Labor or socialist treatment of nationalisation.

The paradox with the comparability regarding the two crises is the fact a comparable solution was obtainable in england. Prior to dilemma smashed, Lloyds TSB planned to purchase Northern Steel with major benefit of some Sterling 30 zillion of ensures from the Traditional bank of Britain. At that time, the Governor with the Traditional bank of Britain favored to spiel around the perils of ethical peril involving bailing out banking institutions.

Unease concerning the knowledge with the Traditional bank of Britain is higher by way of the Tolerate Sterns affair. You will find there's obvious absence of self-confidence in ale frequently the UK federal or even the Traditional bank of Britain to counteract a repetition of the Northern Steel disaster. That is why, dark rumours will continue to circulate about other British banking institutions. It can be obvious the fact that dilemma is way from over, along with the Traditional bank of Britain will again be placed on the analyze.